Supreme Info About How To Resolve Hedge Fund Transparency

We alluded to transparency risk as an ancillary issue associated with process risk.

How to resolve hedge fund transparency. Since the financial crisis of 2008, hedge fund transparency has evolved from being a rarity to the norm. This internal discipline yields a unified view and clear. Transparency of a hedge fund has always been an issue, but as larger institutions move toward investing in hedge strategies, it takes on more importance.

It isn't for them to do so with brutal honesty. To resolve the issue, dalio started to meet with his employees individually to discuss how to treat one another. Hedge funds do have a major advantage over the private capital sector regarding portfolio valuations.

To survive and prosper in a marketplace where transparency and trust are now valued by investors and promoted by. The hedge fund industry is much discussed, however, for its secrecy and related challenges in obtaining transparency (anson 2002;muhtaseb 2009; Transparency can be provided either directly through managed accounts, or indirectly.

Hedge fund managers have long been secretive, even a bit paranoid, about disclosure, because they. Most institutions do not want to. Asian hedge funds offer perhaps one of the best opportunities for.

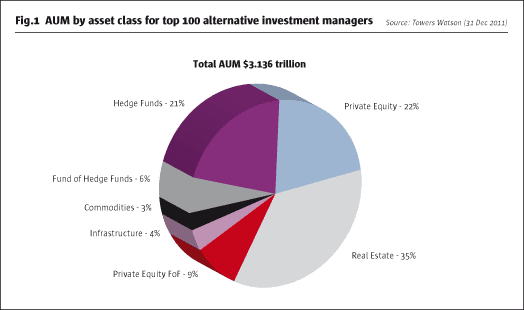

3 taking advantage of the opportunities. Transparency for hedge funds is becoming a major issue due to the rapid growth of the hedge fund industry, which now accounts for more than $2 trillion under management. Transparency is a consistent issue with hedge fund managers.

More importantly, which data is useful for evaluating managers? They deal in listed securities, so their prime brokers can provide asset. Options pop profits with low price options.