Simple Info About How To Settle Your Own Debt

Learning how to remove student loan personal debt is a very important skills.

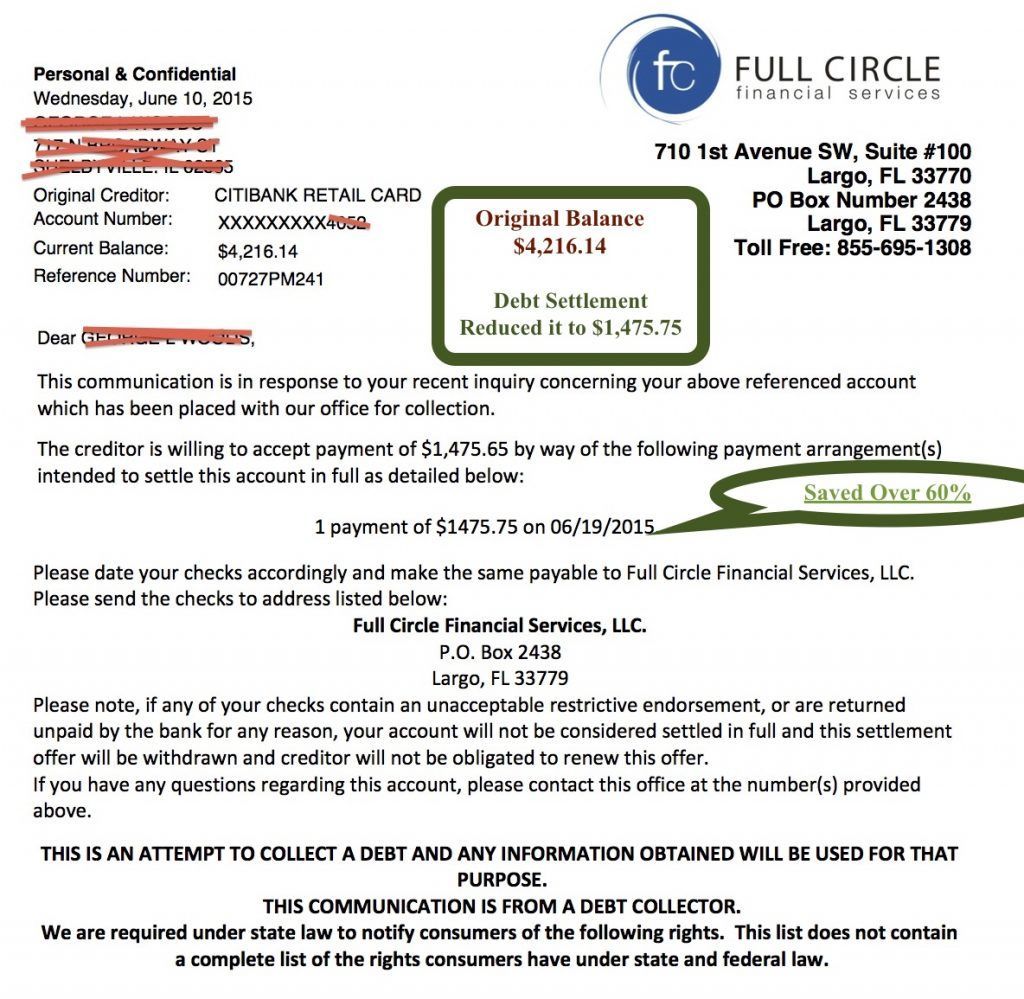

How to settle your own debt. You know that realistically you can expect to settle at around 40 to 50 percent of the balance. You've likely seen and heard ads from companies claiming they can settle your debt with the irs for pennies on the dollar. they claim you need their services to strike a deal. Remove emotion from the equation.

4 steps for successful debt settlement negotiations step 1: As a rule of thumb, if your debt is less than $10,000, it’s usually best to contact the irs yourself to try to arrive at a payment agreement. Some creditors will let you.

The percentage will depend on the creditor, the size of. To settle debt on your own you will need to: If your debt exceeds that amount but is.

Lay out a plan on how to tackle your financial situation. Our program has helped over 100,000 of our clients pay off over $5 billion. How to settle debt on your own step one:

They will be tempted to take available cash now rather than come up with a new debt repayment. Set up a separate savings account. Ad fill in one simple form & get the best personal loan offers for you.

Creditors can make diy debt settlement difficult. You may be able to save money with a diy debt settlement. The consequences away from education loan obligations can lead to monetary suspicion.