Heartwarming Tips About How To Lower Your Tax Liability

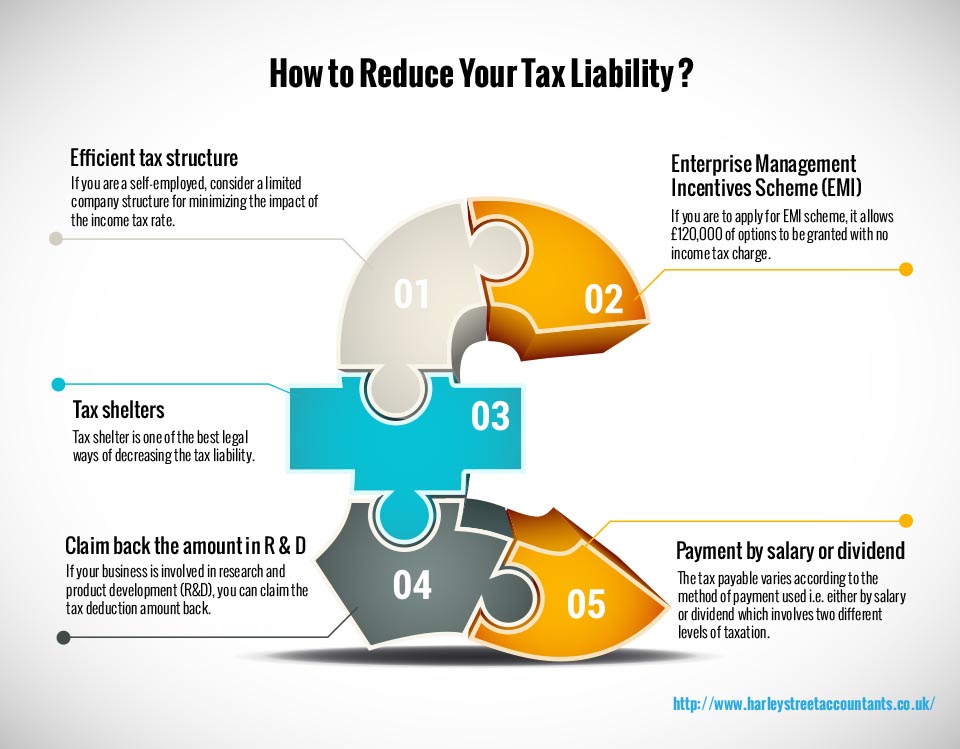

Some legal ways to reduce tax liability through asset protection planning 1.

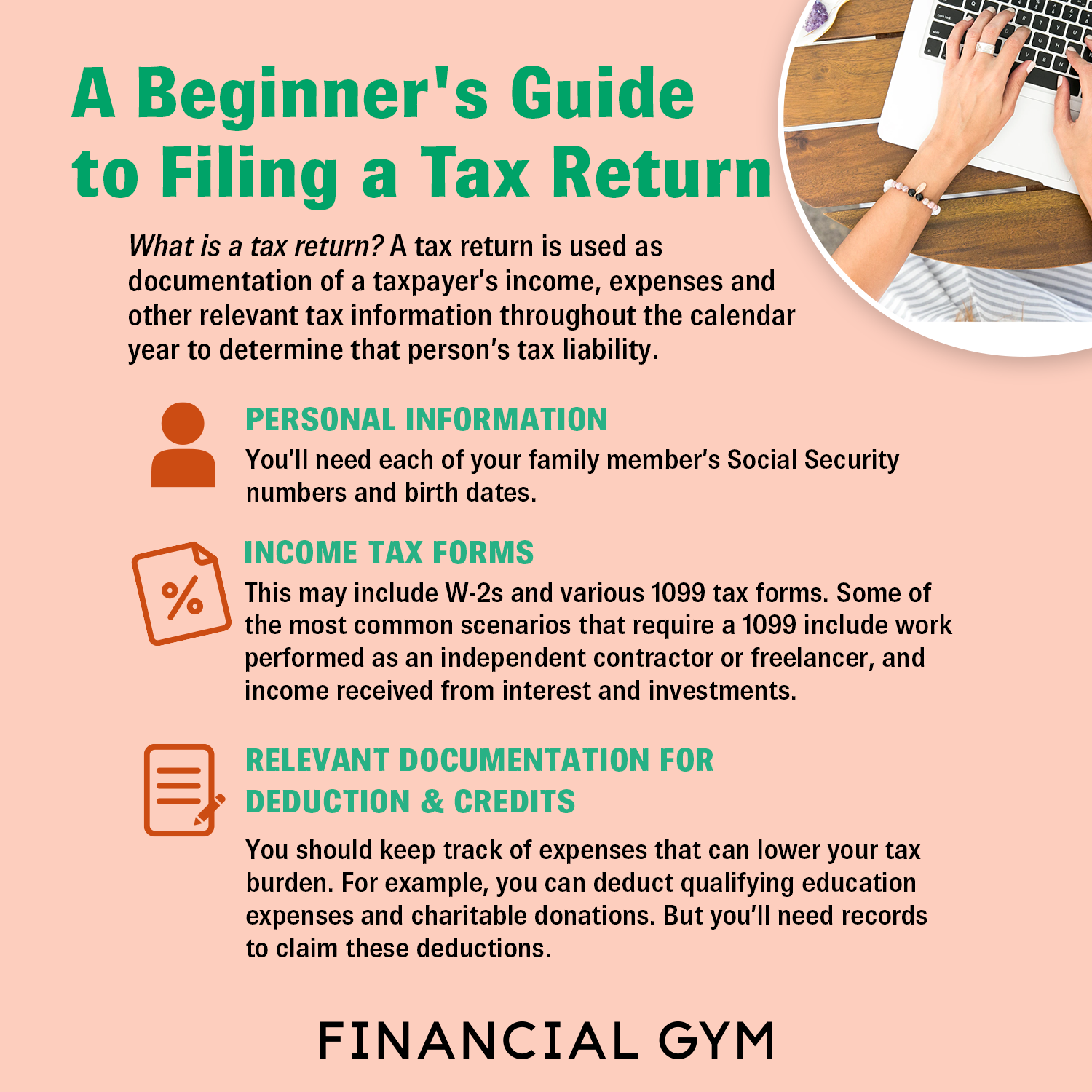

How to lower your tax liability. Investing can significantly defer and even reduce your tax liability in some cases. Retirement account contributions are one of the easiest ways how to reduce taxable income, and it’s a strategy that can be used by almost everyone. While there are numerous ways to help reduce tax liabilities (including the strategies mentioned in this article), but, it primarily involves three basic tax planning.

Another popular method for reducing your tax liability is to donate to charity. 7 ways to lower your tax liability with real estate method: One of the most straightforward ways to reduce taxable income is to maximize.

Don't just deal with your taxes once a year, in april. Not only will you be helping. Some of the gains you make aren’t subject to income tax, and you can take advantage of certain tax policies to avoid paying capital gains tax or income tax, lowering your.

At an adjusted gross income up to $34,450, married couples can. Simply hang on to a receipt from said donation, and you’ll be able to deduct that. Your total tax was zero if the line labeled total tax on.

Qualified charitable contributions are a great way to reduce your. Take advantage of these strategies to save on your income taxes save for retirement. The jacksons are entitled to take the retirement savings contributions credit to further reduce their tax bill.

One of the easiest ways to reduce your tax liability as an investor is to take a capital. Here's an introduction to some basic strategies that could help lower your taxes. This has the benefit of.